Interest from majors shows that Bangladesh is still on the exploration map

It is too early to conclude that there is nothing left to find in Bangladesh, despite declining production figures.

It is too early to conclude that there is nothing left to find in Bangladesh, despite declining production figures. Proposed changes in Production Sharing Contracts form an important factor in stimulating exploration offshore.

By Thomas Davis, Ventura, CA, and Badrul Imam, University of Dhaka

Gas is the dominant energy source for power generation in Bangladesh; it has fueled the nation’s rapid economic growth during the last several decades. However, dwindling domestic production, mostly from fields discovered before 2000, and growing LNG imports are making the nation more energy dependent on external events.

The exceptional LNG price spike from the Russia-Ukraine war and the government’s three-quarter-year pause on spot market purchases are a testament to that.

Increased gas exploration in resource-rich Bangladesh would alleviate its energy concerns and avoid economic contraction. Although the spot price of LNG is now considerably lower than in the recent past, concerns remain about future spikes, a gradual and sustained price increase over time, and the reliability of external supplies.

46 new wells

In a 2021 GEO ExPro article, we already advocated for increased gas exploration of the many opportunities in Bangladesh. If anything, the market and supply experience of the last two years has strengthened that position.

Here, we focus on offshore exploration and recent government moves to increase exploration countrywide. Petrobangla has announced plans to drill 46 wells in the next two years: 17 exploration wells, 12 development, and 17 work-over wells, with five exploration wells to be drilled in 2023 and 12 in 2024. In contrast, the last two decades only saw 1 to 2 exploration wells drilled per year.

At the same time, accompanying commercial enticements and planned bid rounds should increase exploration interest from international oil and gas companies (IOC), with Petrobangla’s proposed changes to the offshore Production Sharing Contracts (PSC) awaiting approval by the relevant authorities.

Changes include natural gas pricing tied to 10% of Brent Crude Oil, e.g., Brent at $80 USD/barrel will result in gas priced at $8.00/MCF. Petrobangla also proposed to reduce its take of “profit gas” to a mean of 55% from 67.5%.In addition, IOCs with future offshore discoveries can export gas when production exceeds domestic demand.

And finally, Bangladesh resolved its maritime boundaries in the Bay of Bengal with India and Myanmar by 2014, resulting in the offshore sector having an Exclusive Economic Zone that is nearly double that of the nation’s onshore area.

A large under-explored delta

A significant part of the offshore Bangladesh sector is occupied by the under-explored Ganges-Brahmaputra delta, the largest delta in the world. Productive oil and gas basins lie in adjacent offshore India and Myanmar: the Krishna-Godayari and Mahanadi, and Rakhine Basins, respectively, with large recent gas discoveries made in the adjacent Myanmar offshore sector.

However, compared to its neighbours, the offshore sector of Bangladesh is poorly-explored: only 21 shallow-water and no deep-water wells.

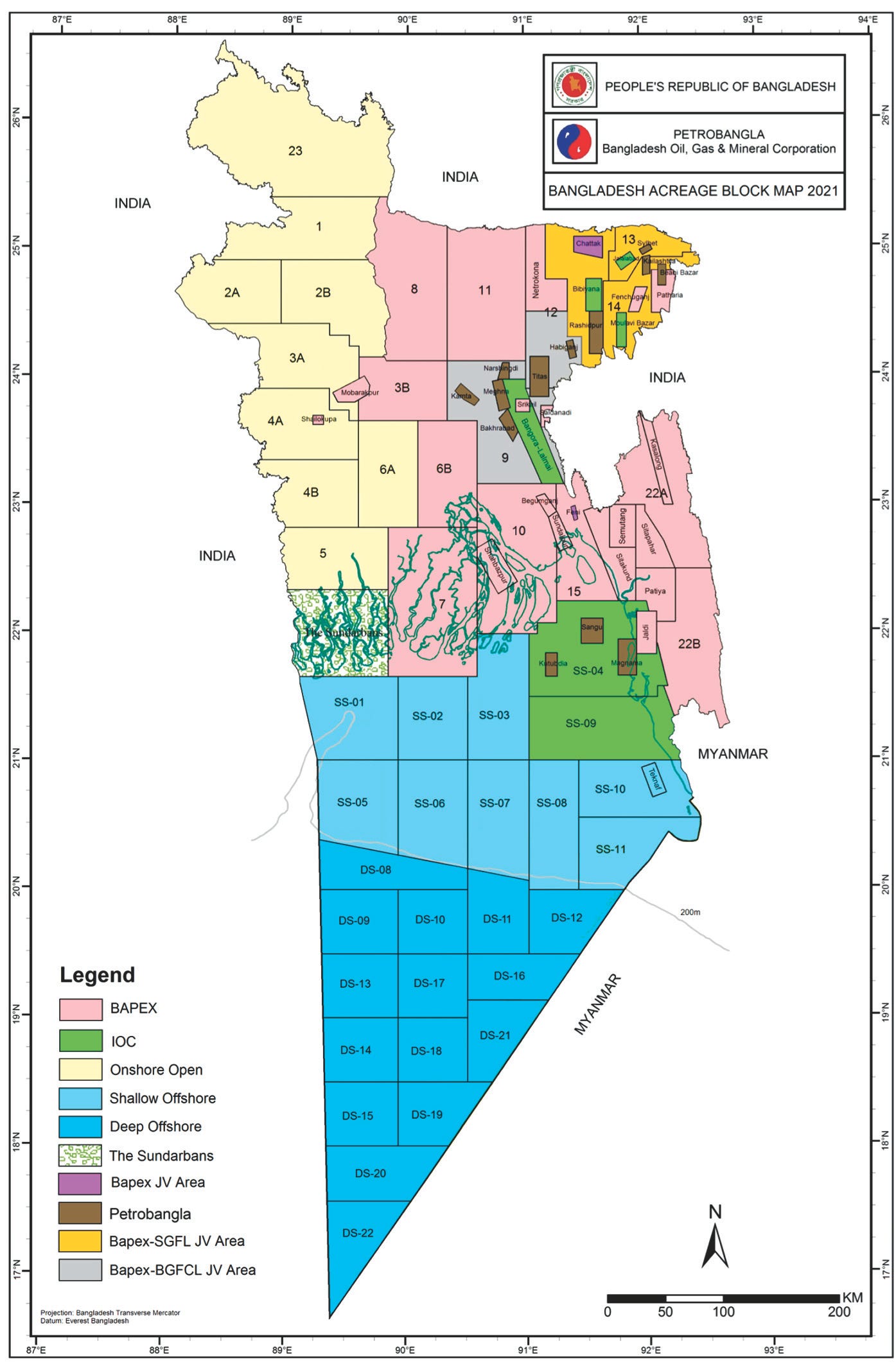

The planned offshore bid round has 26 blocks: 11 shallow water and 15 deep water blocks (> 200 m depth, Figure 1). A 2001 Petrobangla/USGS (United States Geological Survey) Natural Gas Assessment estimated the undiscovered, conventional resources in the shallow-water Bangladesh sector at 8.8 TCF (mean) with a range of (2.4 - 17.4 TCF). The shallow-water zone has two gas fields: the undeveloped Kutubdia discovery (1977) estimated at 780 BCF and Sangu that produced 488 BCF (produced from 1996 to 2013).

Geological data indicate that the offshore has significant remaining natural gas resources, further de-risked by major oil and gas discoveries in adjacent waters in Myanmar and India.

Several stratigraphic plays and trap opportunities are known to exist:

1) Ganges-Brahmaputra delta system with sand-rich fluvial-channel pinch-outs, abandoned channel-fills, levee and crevasse splays, distributary channels, mouth-bars, abandoned delta-lobes, and tidal-bar traps.

2) Onlap sand facies in transgressive coastal settings and sand pinch-outs along the slope.

3) Deep-water turbidite systems: Mio-Pliocene age, sand-rich deposits that occur across most parts of the offshore.

While the wide range of untested stratigraphic plays and traps hold great promise, there are equally promising structural plays and traps in the Bangladesh offshore sector.

Geological and geophysical studies suggest the deeper portions of the Bay of Bengal (Hatia Trough and Rakhine Basin) show a well-developed, gravity-controlled, deep-water fold belt. In other parts of the world, these fold belts form important oil and gas provinces (e.g., Gulf of Mexico and Niger Delta).

New seismic acquisition

As a strong indication to Bangladesh’s offshore prospectivity, the 2023 S&P Global Commodity Insights report states ExxonMobil is in talks with the government of Bangladesh to explore all 15 deepwater blocks under the new PSC model, in addition to possible onshore exploration.

Should the PSC between ExxonMobil and Petrobangla be approved, much-needed 2D/3D seismic surveys of the offshore sector will be acquired. This should highlight low-amplitude closures above listric normal faults in shallow waters that are common to large deltas with high-sediment load. Likewise, in the far southeast of the offshore, poorly defined anticlines and other convergent traps can be expected along the western edge of the Chittagong-Tripura fold belt.

Avoiding economic contraction and helping the climate

If the present decline in gas production from Bangladesh continues, some forecasts show that coal and gas consumption will be at parity in power generation by 2040 at around 35% each. In order to slow the growth of coal or even decrease its use in the energy mix, Bangladesh has got an alternative and that is ramping up gas consumption from new discoveries.

Rather than in some countries where there is nothing much left to explore for, Bangladesh finds itself in a different position where there is potential to make significant discoveries in the offshore sector. Given that international majors have already expressed interest in exploring the offshore area forms independent proof of this.

Against that backdrop, new seismic acquisition, state-of-the-art processing and mapping and interpretation guided by geological modelling over the under-explored Bangladesh offshore has got great potential to define stratigraphic and structural traps to be evaluated by the drill bit in the coming years, aided by the drilling program already announced.

Domestic gas production will not only help reduce the dependency on an unpredictable LNG market, it will also result in a cleaner energy mix and create a more stable path towards economic growth.

You need this book. Will answer your questions. Thom

Bangladesh Geosciences and Resources Potential https://a.co/d/5EqX3qu

Thom,

What can you tell us about the source rock? What age? Biogenic or thermal? Maturation level? Any chance for a deeper oil prone source rock?